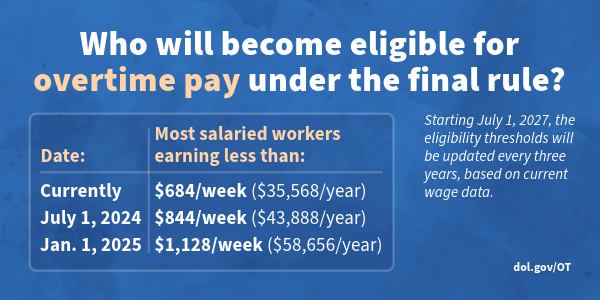

In April, the Department of Labor (DOL) released a final ruling that is projected to significantly increase the threshold for overtime pay for lower-paid employees. Starting July 1, 2024, salaried workers making less than $844 per week will be eligible under the law for time-and-a-half overtime pay. Under the ruling, starting January 1, 2025, salaried workers making less than $1,128 per week will become eligible for time-and-a-half overtime. Going forward, the DOL plans to reevaluate and update overtime protection based on current data every three years.

By January 2025, the overtime threshold would increase by nearly 65% under the law, impacting millions of workers. The new ruling faces heavy opposition and will likely go to court.

But if this ruling stands, what might it mean?

FLSA Overtime Protections History

In 1938 President Franklin Roosevelt signed the Fair Labor Standards Act (FLSA) as part of his New Deal reforms. The FLSA marked the beginning of American overtime protections, mandating time-and-a-half pay for all hours worked beyond 40 in the course of a week. We can attribute the traditional five-day, eight-hour, working week to the FLSA.

In addition to overtime, the act eliminated child labor and implemented the national minimum wage.

When the FLSA was established, minimum wage, median wage, and the overtime threshold were set in a 0.5 to 1 to 1.5 ratio. Meaning, the minimum wage was set to one-half of the median wage, while the overtime threshold was set to one-and-a-half times the median wage. In consistency with this fixed ratio, the FLSA was updated consistently every five to nine years until the mid-1970s.

Through this period, overtime pay functioned as a vital source of income for middle-class workers. It was also a protective barrier against labor exploitation, as employers hired more workers to avoid the extra cost of pricey overtime pay. At this time, around 60% of all salaried workers qualified for overtime pay.

After 1975, the FLSA departed from the 0.5 to 1 to 1.5 wage ratio and went through longer stretches without updates, the longest being 29 years. These stretches combined with inflation loosened the effects of the FLSA’s overtime protections.

In 2016, there was an attempt to significantly increase the overtime salary threshold. This 2016 FLSA update faced considerable opposition and was blocked in court by a federal judge under the ruling that too many individuals performing management duties would also become eligible for overtime. Most recently the FLSA was updated in 2019.

Under the new 2024 final rule, the number of qualified workers would increase from around 15% to around 30%. However, this update also faces opposition and like the 2016 FLSA ruling, will likely be taken to court.

Unpacking the New Final Rule

The DOL created the FLSA update after hosting 30 country-wide listening sessions and reviewing over 33,000 written comments.

The FLSA’s overtime salary threshold helps categorize which salaried workers are eligible for overtime pay protection. The table to the left from the DOL outlines the new salary thresholds and their implementation dates:

However, salary level is not the only criterion for exemption from overtime pay. Employees who are considered legitimate executives, administrators or professionals qualify for what is commonly referred to as an “EAP” exemption.

Employees who are considered highly compensated (or HCEs) will also experience an increase in their overtime threshold. HCEs are individuals who either earned more than $155,000 and were ranked in the top 20% of compensation, or owned more than 5% of interest in the business during the year or year prior (regardless of earned compensation).

On July 1, 2024, HCEs making under $132,964 per year will qualify for overtime compensation. On January 1, 2025, HCEs making under $151,164 per year will also be eligible. HCE employees also have overtime compensation exemption criteria.

The FLSA overtime compensation threshold will be updated based on current data and repeated every three years.

What This Change Means for Employers Tracking Time

The increase in the overtime pay threshold is an attempt to strengthen and expand overtime protections and economic security to an estimated 3.6 million American employees. It also is intended to provide predictable guidance for employers on how they will pay their employees moving forward. With the significant increase, the increase is divided into two phases, to allow employers time to adjust.

The new ruling will make accurate time and attendance tracking more important than ever. If the final rule is implemented, it will be imperative for both hourly and salaried employees to clock every working hour.

For more information on simple and efficient time and attendance solutions, contact us today!

This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for legal advice. If you have any legal questions regarding this content or related issues, then you should consult with a labor attorney for advice.