Pay on Demand™

On-demand wages, whenever your employees need them.

Gain an edge over your competitors on the job market. Through Attendance on Demand™, offer an on-demand pay benefit for your employees, at no cost to your business.

Competitive Recruiting & Employee Retention

On-demand wages are simpler and more accessible to employers and employees than ever, boosting current employee engagement and strengthening recruitment strategies.

Download our myth-debunking guide to learn about the pros and cons of an on-demand pay benefit:

Pay on Demand Basics

It isn't a loan.

Pay on Demand™ only allows employees to receive pay for time they’ve already worked but haven’t been paid for yet.

There are no fees. Ever.

With Advanced Time, employers using Pay on Demand™ pay no fees or transaction costs, and there’s no fronting funds for advance wages.

There's no impact on payroll processes.

Pay on Demand™ doesn’t require any changes to employer payroll. All money is advanced and collected by a secure third party.

It links to Attendance on Demand™.

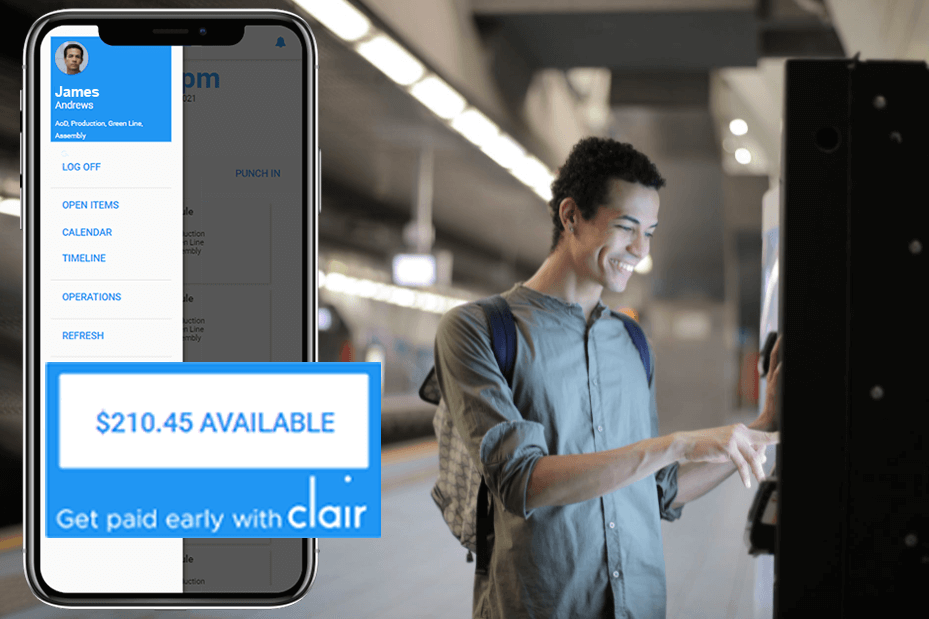

Easily accessible through the Attendance on Demand™ app, employees can quickly and easily access payment for their worked hours through Clair.

It's an incredible benefit for employees.

When unanticipated expenses arise, employees won’t need to wait to access the necessary funds from their next paycheck. It offers employees greater liquidity and improved financial health.

How it Works

1. During setup, the employee will set up direct deposit through Clair, the third-party service provider partnered with Attendance on Demand.

2. The employee works their shift.

3. After clocking out at the end of the shift, Clair notifies them that a percentage of their earned wages is accessible.

4. The employee can request funds through the Clair app, up to a percentage of their daily wages.

5. Advanced funds can then be used at a retailer using Tap to Pay, withdrawn from an in-network ATM or transferred to another bank account.

6. On payday, the money advanced is deducted from the amount of their direct deposit and they receive the rest of their due funds.

A Necessary Service

An estimated 64% of Americans live paycheck to paycheck, falling back on predatory financial bandages like credit cards, personal loans or payday loans when unexpected expenses arise.

On-demand wages allow employers to offer peace of mind to their employees worried about making it until their next paycheck.

Who We Help

We serve a wide variety of industries including the below. Click on each icon to learn more about how we can help meet each industry's needs.

Agriculture

Government Agencies

Construction

Grocery

Healthcare

Landscaping

Manufacturing

Nonprofits

Professional Services

Staffing Companies

Blog: The Rising Popularity of Wage Advance

In the ongoing challenge to obtain and retain high-quality talent, businesses are exploring unique incentives that could set them apart. The most effective incentives meet their employees’ real needs,like wage advances or daily wage offerings.

Blog: Benefits of Offering Daily Pay

Employee Benefit News says that “the single most important benefit” in a post-COVID-19 world is the ability to offer employees a percentage of their daily wages. This isn’t only due to the positive impact on employees, but the benefits to employers as well.

Webinar Recording: Exploring Wage Advance

Join Dan Corp, President of Advanced Time, and guest speaker Harry Monahan III from Attendance on Demand™ as they explore the ins and outs of wage advance and the impact it can have on your employees.